|

|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

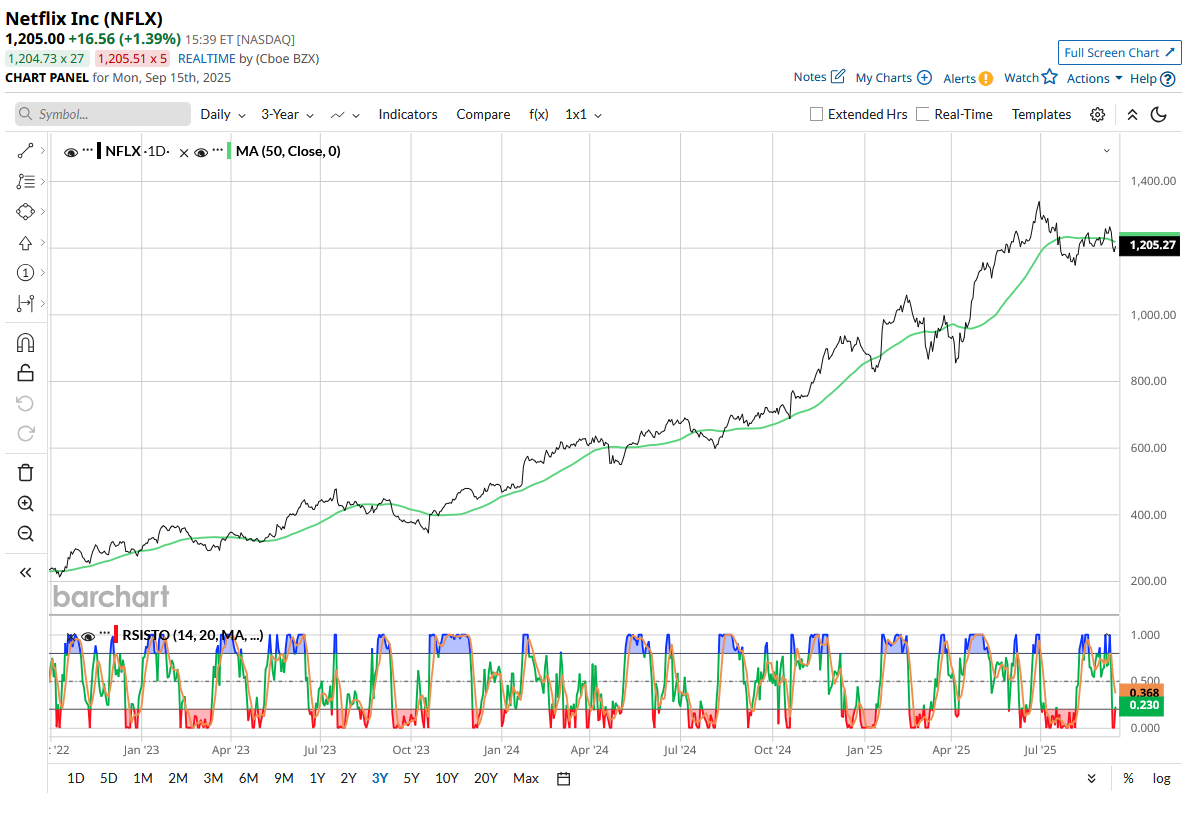

As Netflix Stock Falls Below $1,250, Should You Binge Watch Or Keep Chilling?

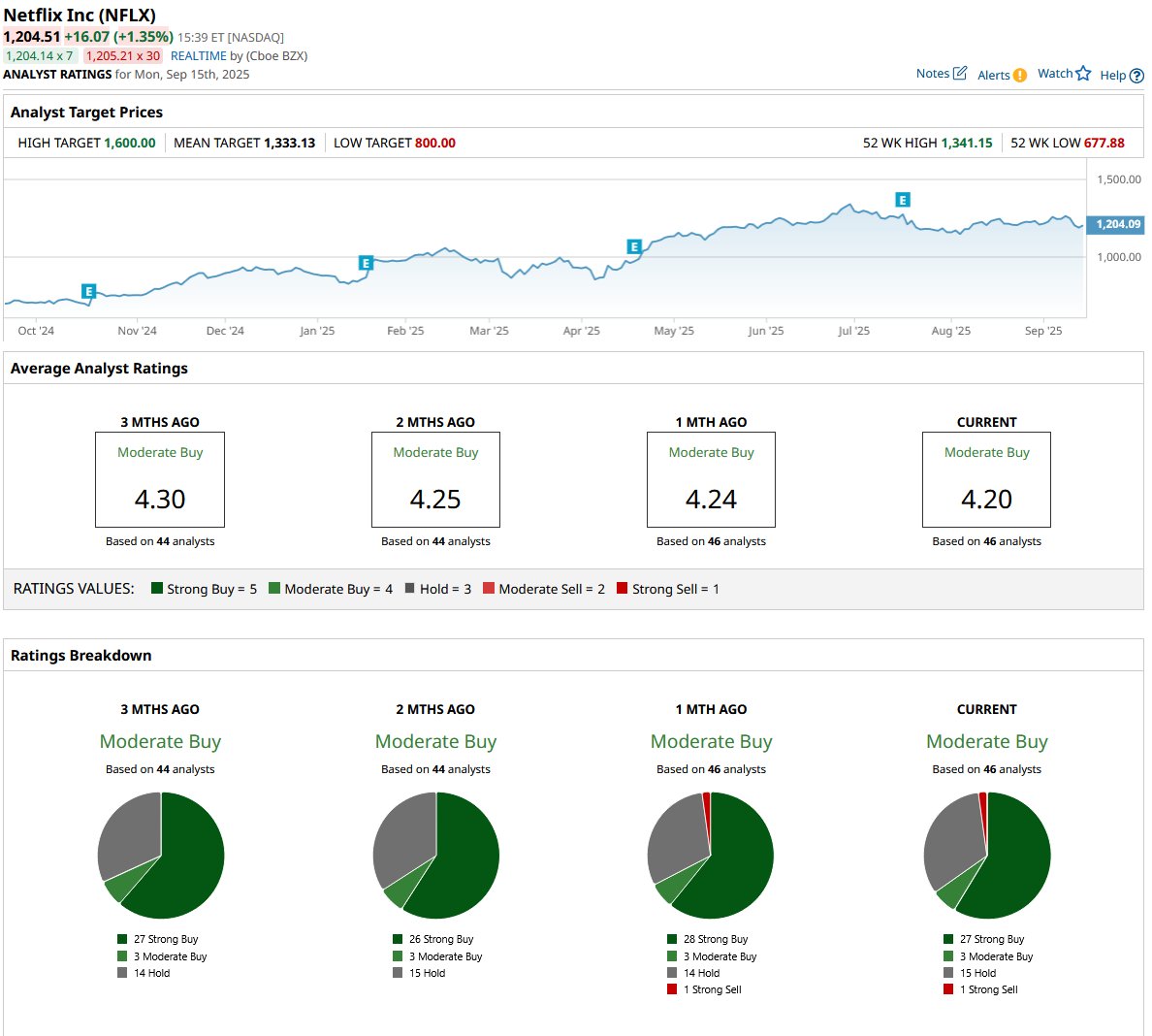

The fortunes of Netflix (NFLX) stock have been quite mixed this year. It established itself as a rare defensive play in the tech space, and while broader markets plunged amid the tariff chaos, it outperformed Big Tech peers by a significant margin in the first four months of the year. However, while the broader markets roared back and the S&P 500 Index ($SPX) has closed in the green for four consecutive months after the April meltdown, NFLX stock is in a correction zone after having fallen over 10% from the record highs it hit in late June.  Why Has Netflix Stock FallenAs the trade uncertainty started easing, investors pivoted to more cyclical names, which lowered the appeal for defensive plays like Netflix. It didn’t help that Netflix’s forward price-earnings (P/E) multiple expanded into the 50s, which even some of the bulls, including myself, found hard to justify. Netflix beat on both the topline and bottomline in Q2 2025 and raised its annual guidance. However, stock still fell after the Q2 confessional as markets expected “more” from the company after its year-to-date outperformance. Netflix stock is now trading below $1,250 and has practically gone nowhere over the last four months. In this article, we’ll explore whether it makes sense to buy NFLX stock at these price levels. NFLX Stock ForecastOf the 46 analysts covering Netflix, 27 rate it as a “Strong Buy,” while three rate it as a “Moderate Buy,” 15 rate NFLX as a “Hold,” while one gives it a “Strong Sell.” Netflix has a mean target price of $1,333.13, which is 12.2% higher than the Sept. 12 closing prices, while the Street-high target price is $1,600. The overall Street sentiment towards Netflix has been mixed, though. Since May, J.P. Morgan, Philip Securities, and Seaport Global have downgraded the stock. While there were some customary target price hikes following the Q2 2025 release in July, none were significant. NFLX stock has outperformed significantly over the last two years, led by strong growth in its subscribers and profits. Thanks to the password-sharing crackdown and lower-priced ad-supported tier, Netflix added a record 41 million subscribers last year, which helped lift its subscriber count beyond 300 million. Meanwhile, Netflix has stopped reporting quarterly subscriber numbers as the company sees revenue growth as a better indicator of its performance. What Could Drive Netflix’s Growth?Netflix has witnessed unprecedented subscriber growth between 2023 and 2024, and it would be foolhardy to expect similar numbers over the next couple of years, as the company seems to have already converted many “freeloaders,” or people who were watching its content on borrowed passwords, into paying subscribers. That said, while subscriber growth might slow down going forward, ad revenues would start becoming a significant contributor to Netflix’s earnings. While Netflix does not provide a dollar figure for its ad business, it reiterated that its ad revenues are on track to double in 2025, following similar growth last year. In the next couple of years, ad revenues will become a significant driver of Netflix’s growth story as the company adds more subscribers to the ad-supported tier and its ad sales start taking off. The company has developed its own ad tech stack, which will enable it to enhance the overall experience for both advertisers and subscribers. Netflix has also partnered with Amazon (AMZN) under which advertisers using Amazon's demand-side platform (DSP) will have direct access to Netflix's ad inventory in 11 markets, including the U.S., Canada, and the U.K. Is NFLX Stock a Buy Now?Netflix now trades at a forward P/E of 46.2x, which is not exactly mouthwatering. For context, among the “Magnificent 7”—of which Netflix is not a part, even though I contend it should be—only Tesla (TSLA) trades at a higher multiple. Netflix does bring in prospects of strong topline and bottomline growth in the foreseeable future and has established itself as a preeminent streaming play with a strong moat and a loyal and engaged (read hooked) user base. Also, a strong and growing content slate, partnerships with other broadcasters like it did with TF1 in France, and the addition of features like live sports will help Netflix become even more indispensable for users, which would mean higher pricing power. That said, while I am constructive on NFLX over the medium to long term and have no intentions of selling my holdings, I don’t find enough margin of safety in NFLX at these levels to trigger a fresh purchase.  On the date of publication, Mohit Oberoi had a position in: NFLX , TSLA , AMZN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|