|

|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Corn, Soybean Markets See ‘Sell the Rumor, Buy the Fact’ on USDA Data

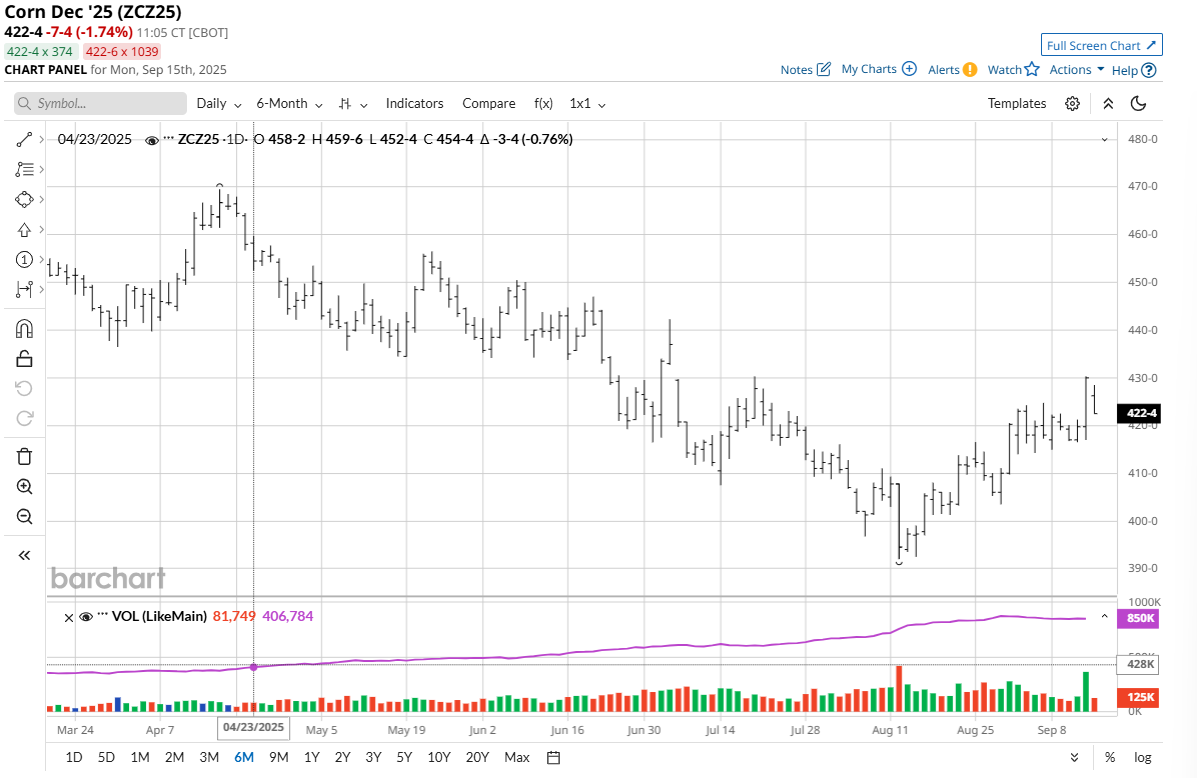

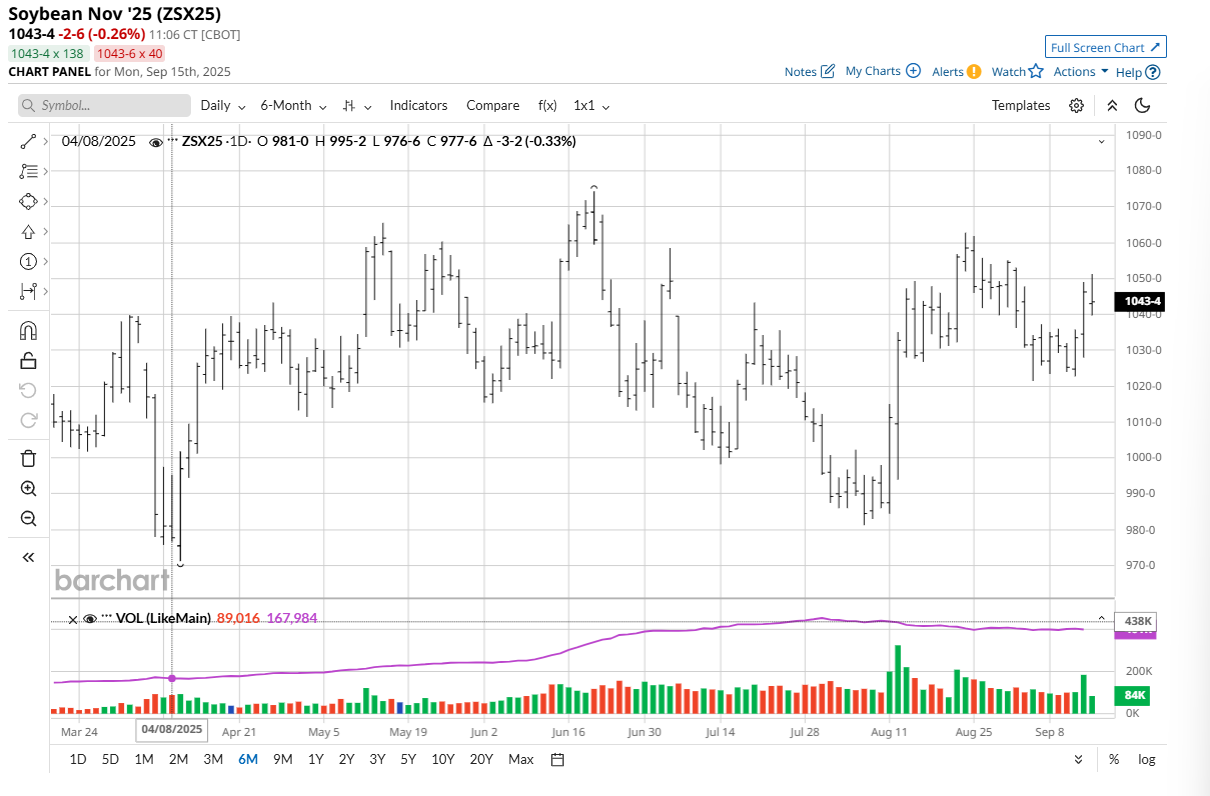

Before the monthly USDA supply and demand report was released on midday Friday, corn (ZCZ25) and soybean (ZSX25) bulls were hoping that big U.S. corn and bean crops were already factored into futures prices. It appears they got their wish. December corn rose 10 1/4 cents to $4.30 on Friday, near the daily high, and hit a seven-week high. For the week, corn was up 12 cents. November soybeans gained 12 3/4 cents on Friday to $10.46 1/4, nearer the daily high and on the week up 19 1/4 cents. Both markets closed Friday at technically bullish weekly high prices. The USDA on Friday pegged U.S. corn production at 16.814 billion bushels, whereas the trade expected 16.502 billion bushels and compares to 16.742 billion bushels projected in the August USDA report. The agency raised its production estimate by 72 million bushels from last month. It decreased the average corn yield 2.1 bushels to 186.7 bushels per acre. The agency forecast U.S. soybean crop production at 4.301 billion bushels, whereas the trade expected 4.262 billion bushels and compares to 4.292 billion bushels projected in the August report. The USDA increased its soybean production estimate by 8.5 million bushels from last month and decreased yield 0.1 bushels to 53.5 bushels per acre. Indeed, it appears grain traders on Friday showed a classic “sell, the rumor, buy the fact” scenario as corn and soybeans rallied in the face of bumper crop projections from the USDA.

Corn, Bean Bulls Need to Show Follow-Through Strength This WeekKey for the corn and soybean bulls this week is to show important follow-through buying that would better suggest seasonal market bottoms are in place and that prices can even begin to trend higher for soybeans and extend the price uptrend in place in corn. Sustaining the price uptrends in corn and soybean futures in the early fall will be challenging for the corn and bean bulls. Harvest pressure and related commercial hedge selling will ramp up in the coming weeks, which could limit the upside in corn and soybean futures prices. However, the corn market bulls have shown keen resilience lately, despite knowing a big U.S. corn crop is getting ready to come out of the fields in the coming weeks. The soybean market may now do the same. Export Demand for U.S. Corn Remains Solid, Beans Need ImprovementThe USDA last Thursday reported U.S. corn weekly export sales of 539,900 MT for 2025-26 were led by sales to Mexico. A total of 1.17 million MT in sales were carried over from the 2024-25 marketing year. Sales were well below the expected range of 900,000 MT to 2.4 MMT for 2025-26. Still, export demand for U.S. corn has been good recently. New U.S. trade deals in the coming months would likely produce even more global demand for U.S. corn. Weekly U.S. soybean export sales were reported at 541,100 MT for 2025-26. A total of 767,000 MT in sales were carried over from the 2024-25 marketing year. Traders expected sales of 400,000 to 1.6 MMT for 2025-26. For the soybean complex futures to see sustainable price uptrends develop, there will need to be better global demand for U.S. soybeans. Traders will remain focused on U.S.-China trade talks in the coming weeks and months as the top global soybean importer continues to shy away from U.S. new-crop soybean purchases. Weather in the Corn Belt Is Off the Front Burner for Corn and Soybean MarketsWeather forecasts call for rain in the Midwest to be infrequent and light in most areas during the next two weeks. Crop maturation and harvesting should advance well but minor declines in corn and soybean crop yields could occur in some areas. However, most corn and soybean crops are too advanced to see significant declines in yields at this stage of the season. Temperatures in the Midwest will be mostly warmer than normal most of this week. Winter Wheat Markets May Stabilize Amid Strength in Corn, Soybean PricesAfter setting contract lows last week, winter wheat futures markets posted gains on Friday in sympathy with corn and soybean market rallies. December soft red winter wheat (ZWZ25) futures last week gained 4 1/4 cents, while December hard red winter wheat (KEZ25) was up 9 1/2 cents for the week. Short covering was featured in the winter wheat market’s price gains last week. Look for the wheat futures markets this week to take the lead from corn and soybean futures. No Surprises for Wheat in Friday’s USDA DataThe USDA Friday cut U.S. wheat estimated 2025-26 carryover by 25 million bushels. The USDA made no changes on the supply side of the 2025-26 balance sheet. On the demand side, USDA added 25 million bushels to estimated exports (to 900 million bushels) to account for the cut to carryover. The USDA puts the national average on-farm cash wheat price for 2025-26 at $5.10, down 20 cents from last month. The USDA last Thursday reported U.S. wheat export sales of 305,400 MT for 2025-26, down 2% from the previous week and down 43% from the four-week average. Sales were at the lower end of pre-report expectations from 300,000 to 650,000 MT. U.S. wheat sales abroad need to significantly improve to help bring the wheat markets out of their tailspins. Wheat bulls are hoping any new trade deals between the U.S. and its major counterparts will include more purchases of U.S. wheat. Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com. On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|